Growth In Value of Listed Stocks Is Far Away From Basics

WORLD GDP has been estimated by DIAWONDS® for the period 1981-2013 based on raw data from World Bank and OECD referred to each country. Where data were unavailable those data were estimated by DIAWONDS®.

Figure 1 shows estimated world GDP at current US$ in trillions as it resulted by aggregating the data pertaining to each single country (red line). The Blue line instead shows annual estimated GDP percentage change. Compound Annual Growth Rate of the world GDP during reference period was 5.9%.

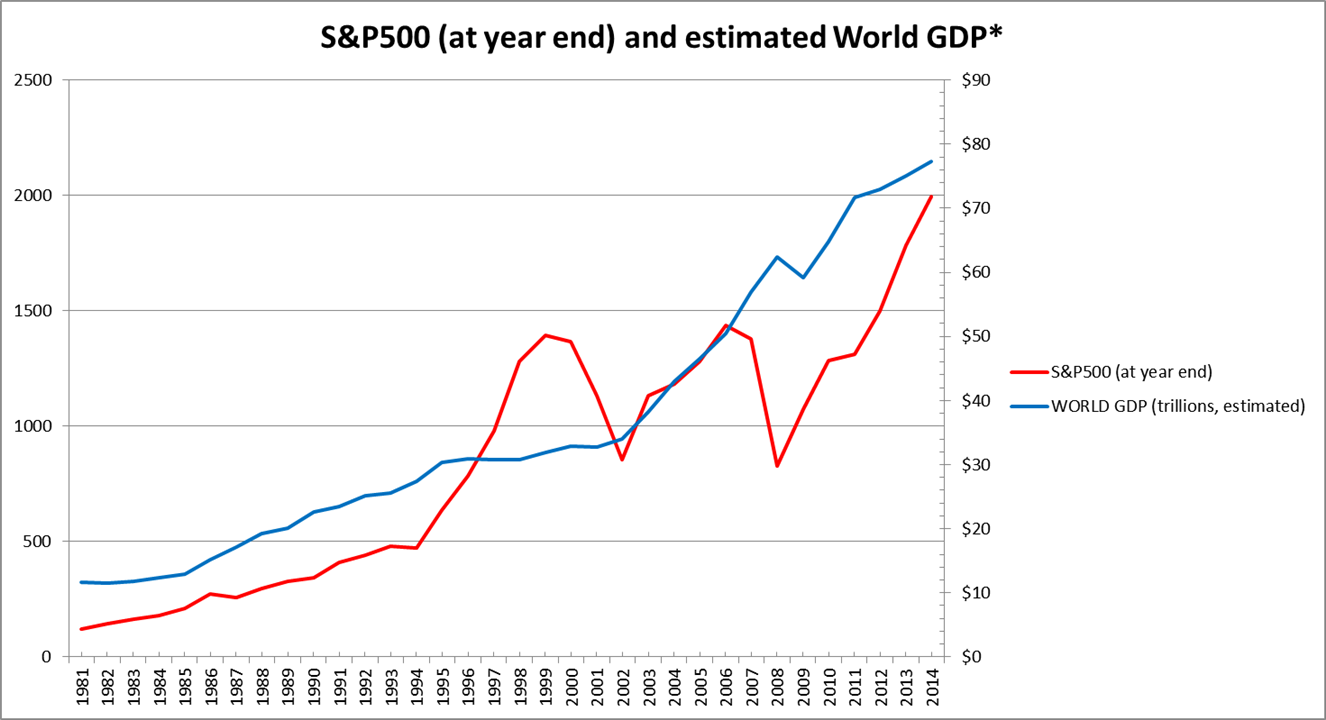

The world GDP annual percentage changes were then compared to the end of year value of the american stock index S&P500 which is representative of U.S. listed stocks price (figure 2).

As shown in figure 2, during last financial crisis (2007-2008) the index fell heavily at the same time of a marked deceleration in the world GDP growth. Later on GDP growth increased substantially and then it fell again to a much lower level while the index kept on increasing.

A gap between index growth and world GDP growth has occurred. Such a gap is meaningful because the S&P 500 index is a good proxy of the overall economy even if it is not representative of all shares listed globally (figure 3). Moreover there is a strong correlation between economic performance of main U.S. listed stocks and that of overall global economy (correlation: 0.86).

Whilst the analysis is limited up to the year 2013, during 2014 the index increased of 12% further, while world GDP growth stayed at a moderate level (+3.6%).

DIAWONDS® believes that said gap is a clear possible proof of overvaluation in U.S. listed stocks considered as a whole.

Milan, april 2015.

Disclaimer: information contained in this post: is provided for informational purposes only and on the condition that it will not form the basis for any investment decision; is statement of opinion and not statement of fact; is not to be considered as a recommendation to purchase, hold or sell any securities; is subject to change; is not intended for any person or entity in any jurisdiction or country where access to it runs counter to prevailing local laws or regulations. No responsibility is assumed for any errors or for the consequences of relying or acting on any information provided in this post. Equity securities, especially small and mid-sized company stocks, are subject to greater risks than bonds.

© DIAWONDS® - all rights reserved.