30 Novembre 2012

POST MACRO. EQUITY.

IS THE FOOD INDUSTRY* FAIRLY VALUED?

Methodology.

I don't try to forecast the future, I just project the past into the future.

When I have to find out the true value of an industrial stock (therefore other than a financial or insurance one) my primary focus is on the Free Cash Flow that may be defined as Operating Cash Flow minus Capital Expenditures. Roughly Free Cash Flow is what remains after deducting from all the cash produced by a company in a year what is strictly needed to its survival.

The Free Cash Flow is what really matters under the point of view of an investor. It's the real value added that may be entirely distributed to the stakeholders without compromising a company's existence. By projecting the Free Cash Flow to the future and discounting it back with the Weighted Average Cost of Capital (it’s the so called Discounted Cash Flow Model), after having performed some other technical steps, it's possible to reach the fair value of one stock to compare with its market price. The big issue here is to choose an appropriate Free Cash Flow growth rate. To accomplish this task, I use to look back into the financial reports of the targeted Company trying to find out how it performed in the past. The same methodology may be extended to a group of peers, part of the same industrial sector, to find out if there is relative overvaluation, undervaluation or if the group, as a whole, looks fairly valued.

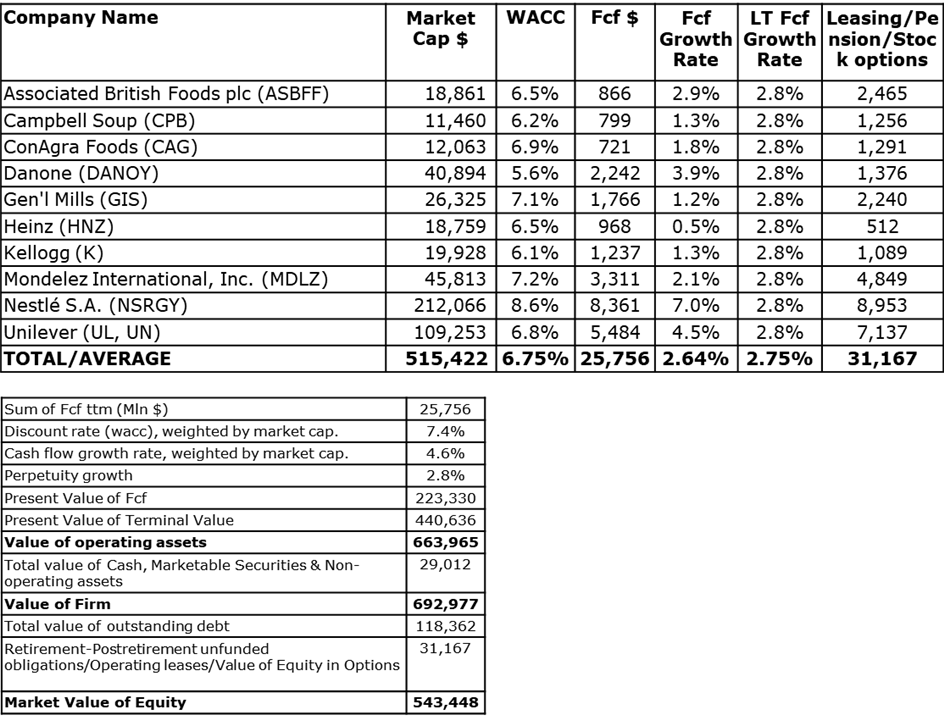

A bundle of peers: ASBFF CPB CAG DANOY GIS HNZ K MDLZ NSRGY UL . Assumptions and results. (Sector: Consumer, Non-cyclical; Industry: Food; *Sub-Industry: Food-Misc/Diversified).

I have estimated the Weighted Average Cost of Capital for each of the over mentioned companies, which are some of the major players in the food processing industry, applying both the Capital asset pricing Model and the Gordon model. I have also estimated reasonable free cash flow growth rates for each company referred to the short-medium and long term. Then I have: computed the trailing twelve moths free cash flow for each of them; looked at the last available amount of unfunded retirement/postretirement obligations; estimated the impact of operating leases and of outstanding stock options (where available).

Here are the results of my assumptions as at the 30th of November 2012:

By comparing the total value of market cap. (515,422) with total market value of Equity (543,448) we can conclude that the bundle of selected companies considered as a whole is just 5.4% undervalued.

Disclaimer: information contained in this post: is provided for informational purposes only and on the condition that it will not form the basis for any investment decision; is statement of opinion and not statement of fact; is not to be considered as a recommendation to purchase, hold or sell any securities; is subject to change. No responsibility is assumed for any errors or for the consequences of relying or acting on any information provided in my post. Equity securities, especially small and mid-sized company stocks, are subject to greater risks than bonds.